Customer retention is arguably the most metric you can measure.

Why?

Clearly, the core of customer retention's importance is financial.

The current economic uncertainty and shifting B2B buying behaviors are shining the spotlight extra bright on customer retention.

Today and far into the future, the B2B companies that separate themselves will be the ones that prioritize customer retention and customer lifetime value (CLTV).

Customer retention measures the percentage of new customers that stay with your business over a specified period of time. Customer retention rate is important for a variety of reasons. Acquiring new customers is typically very expensive, and it’s much more sustainable to retain customers than to continuously sign up new ones. Retained customers are also more likely to adopt new features or products than recently acquired customers.

Customer retention measures the percentage of customers you keep over a certain period of time, while customer churn measures the percentage of customers you lose over a certain period of time.

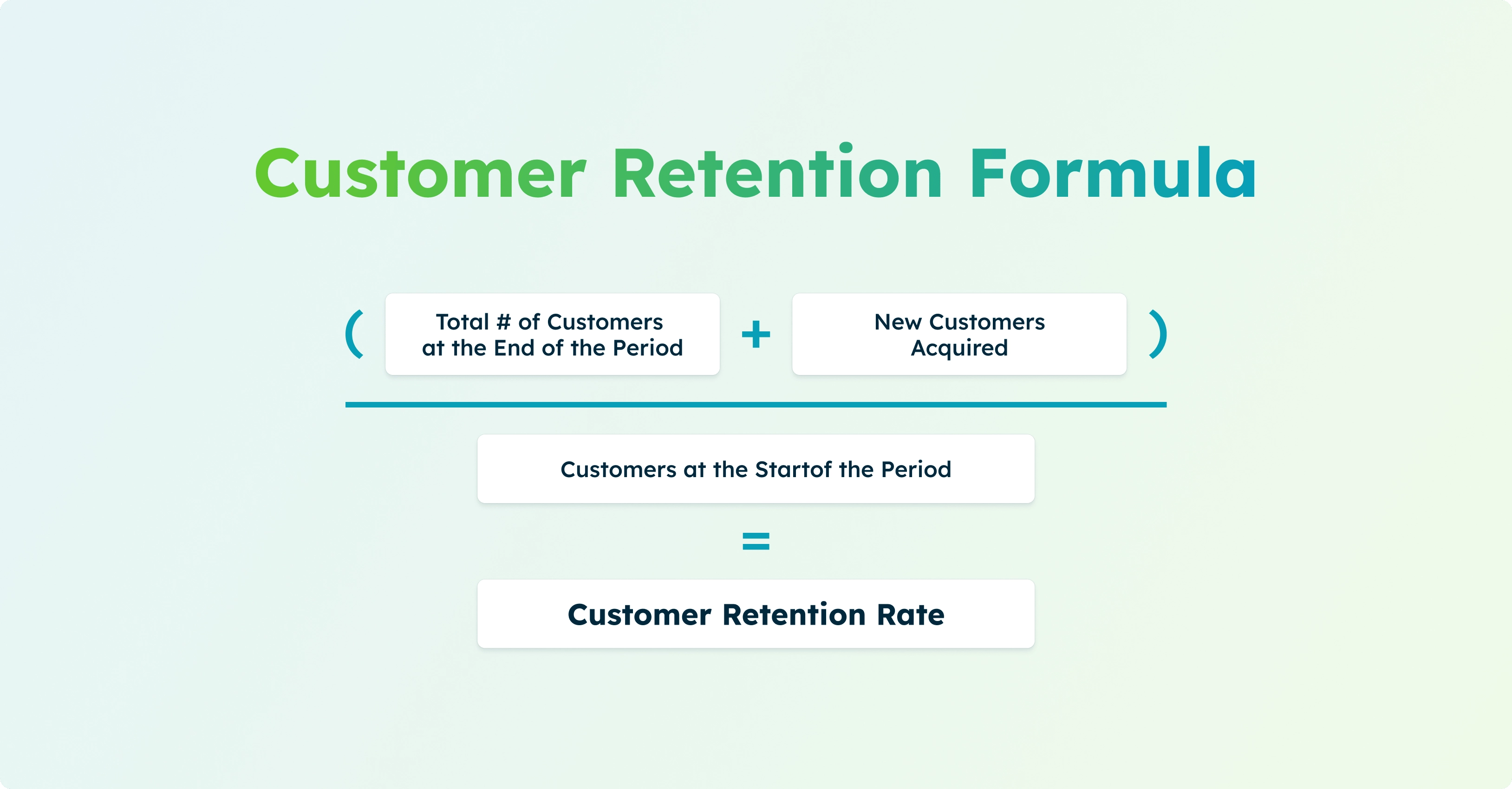

You can calculate your business’s customer retention rate with the following customer retention rate formula:

[(# of customers at end of period – # of customers at beginning of period) / # of customers at start of period] x 100

You can use this formula for any period you want to measure. For example, you could measure your customer retention rate over the past month, quarter, or year — whichever suits your needs best.

You can use this formula for any period you want to measure. For example, you could measure your customer retention rate over the past month, quarter, or year — whichever suits your needs best.

Of course, the most important metric to track is your customer retention rate itself. Your business’s customer retention rate informs you about whether or not your current customer retention strategy is working. If you already have a high rate of retention, you can model your future efforts on what’s currently going right. If your customer retention rate is decreasing, you know you need to take steps to improve your strategy. The following metrics can help you diagnose exactly what might be going wrong or right so you can pinpoint specific successes and address concrete problems.

Customer churn is the inverse of customer retention. Your customer churn rate is the percentage of customers who ended their relationship with your business over the measured period of time. Some churn is unavoidable and expected. However, there are many actions you can take to keep your customer churn rate as low as possible, such as improving customer education.

(# of customers at start of period – # of customers at end of period) / number of customers at start of period

Revenue churn is similar to customer churn, except it measures the amount of revenue you’ve lost over a period of time, not the number of customers. There are a wide variety of reasons for revenue churn. Your customer churn rate is one major contributor to your revenue churn, but revenue churn could also be a result of other factors such as customers downgrading their service packages. Revenue churn from an existing customer (not a churned customer) is a strong indicator that that customer may be a high churn risk. Tracking revenue churn closely can alert you when you need to reach out to customers to offer them additional resources.

[(Monthly recurring revenue at start of period – MRR at end of period) – MRR from upgrades during period] / MRR at start of period

The rate at which your customer base is growing is another metric related to customer retention. If your revenue from customers is growing steadily, it means your customers are spending increasing amounts of money, indicating they’re getting value from your products or services. Customers who are happy with your products or services are more likely to renew their subscriptions and purchase upgrades. Use the following formula to calculate existing customer revenue growth rate:

(MRR at end of period – MRR at start of period) / MRR at start of period

Repeat purchase ratio measures the percentage of customers who have made another purchase from your business after their first purchase. This metric is closely related to customer retention because it helps you gauge the loyalty of your customer base. A high repeat purchase ratio correlates with a high customer retention rate, and a low repeat purchase ratio correlates with a low customer retention rate. This is not true for every type of business, but nevertheless, repeat purchase ratio is generally a useful indicator of the effectiveness of your customer retention strategy.

Number of returning customers / total number of returning customers

Product return rate is another useful metric for managing customer retention — however, keep in mind that it’s mainly applicable to businesses that sell physical products. Product return rate measures the percentage of the total number of products sold that the customer later returned. It’s especially critical for B2B businesses to keep product return rates low because B2B products often represent a considerable investment of time and resources.

Number of product units returned / total number of product units sold

Days sales outstanding is a metric that tracks the average amount of time it takes customers to pay the bills they owe to your business (measured in days). If a customer is paying bills promptly, that can indicate a loyal customer who is interested in maintaining a strong relationship with your company. If customers are taking a long time to pay their bills, it could mean your business is not top-of-mind for them — which does not bode well for customer retention. To calculate average days sales outstanding, use this formula:

(Accounts receivable / annual revenue) x 365 (days in a year)

Net promoter score indicates how likely your customers are to recommend your products or services to other people in their networks. It’s a great metric for determining how satisfied your customer base is. Customers who consistently see value in their relationship with your business often express that satisfaction by telling others about your business. A high net promoter score, therefore, indicates that you are on track to retain many of your customers. To calculate net promoter score, distribute a simple survey to your customer base that asks them to rate their likelihood to recommend your business. Scores of 9 and 10 are your promoters, and lower scores are your detractors.

% of promoters – % of detractors

The time between purchases is the average amount of time your customers take between purchases. If there is a very short average time between purchases, it likely means your customers are happy with your products or services and are eager for more. A long time between purchases tells you your customer retention strategy may not be working well enough.

The combined total of individual purchase rates/number of repeat customers

Customer lifetime value measures the amount of money a customer is likely to generate for your business over the course of their time as a customer. Customer lifetime value is directly linked to customer retention because the longer customers stay with your business, the more money they will spend over time. In contrast, a customer who signs up for your service for a month and then churns has a very low customer lifetime value.

(Average purchase value x average number of purchases) x average customer lifespan

Customer retention is a critical indicator of the overall health of your customer base and, by extension, your whole business. The success of all your operations ultimately depends on your business’s ability to retain customers. Tracking the metrics we’ve covered here is a great way to start gaining a better understanding of customer retention at your company.

Thank you.